The IRS still accepts physical copies of Form 1040 for tax returns. To use the IRS’ Free File Tool, residents must have less than $62,000 in annual income, and must meet additional requirements for deductions and income sources. Hire an individual to file the return who has been granted permission to e-file others’ returns by the IRS.

File for free using the IRS’ Free File tool. residents can file Form 1040 electronically using one of three approved methods:

File for free using the IRS’ Free File tool. residents can file Form 1040 electronically using one of three approved methods:

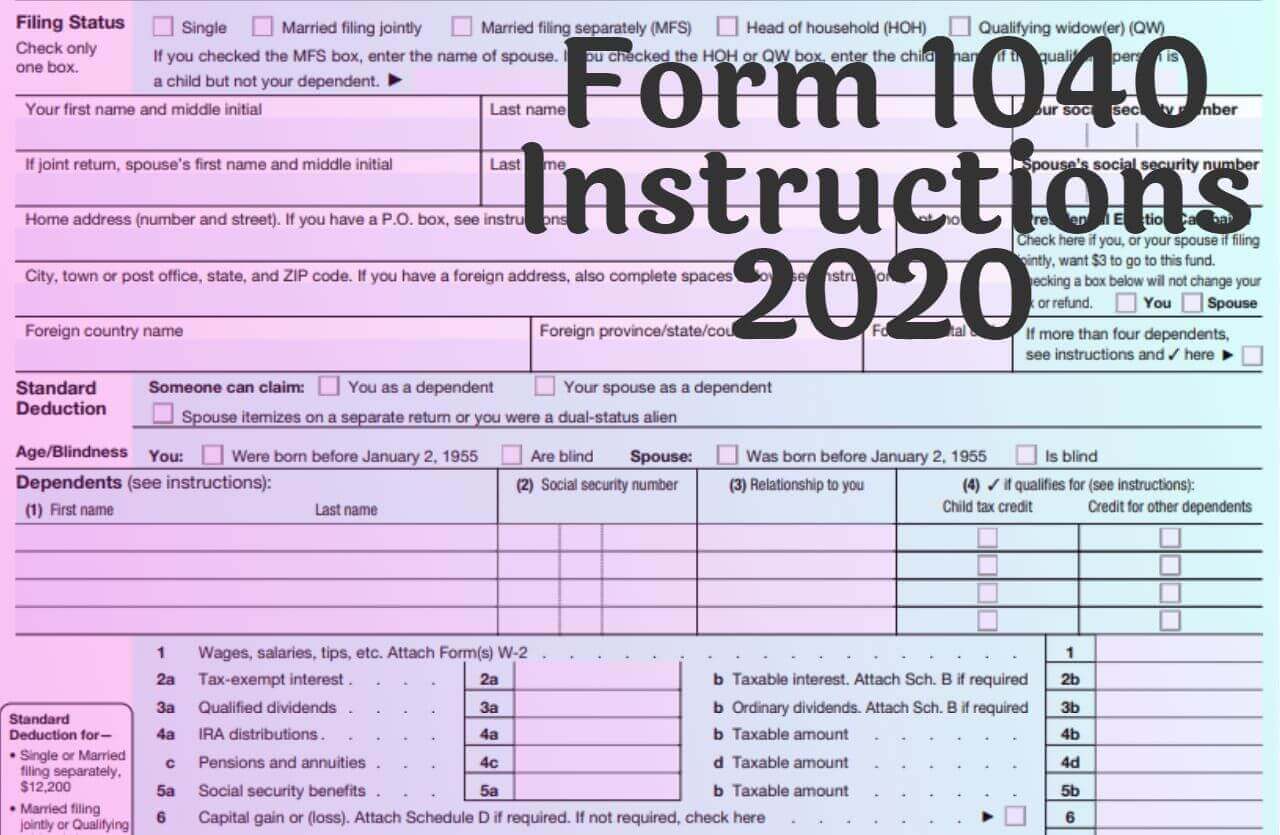

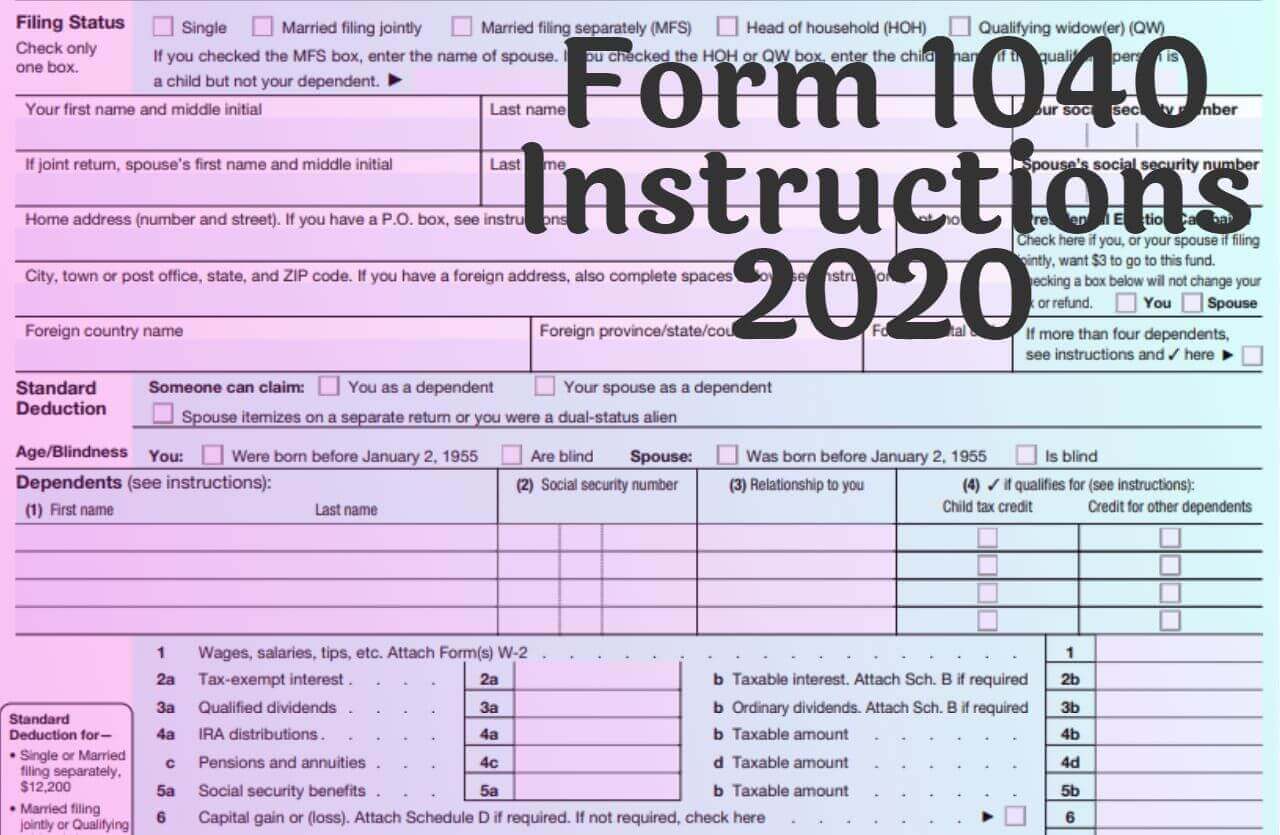

You can file your Form 1040 in one of two ways: Electronic filing of form 1040 In general, you’ll use the standard Form 1040 if you are making itemized deductions, make more than $100,000 per year, or are claiming dependents on your tax return. It’s important to understand which forms you need to file so that the IRS is able to complete your tax return accurately. Keep in mind that there are several versions of the Form 1040, including: On the second page, you’ll fill out information related to the tax deductions and credits that you qualify for. On the first page of the Form 1040 (x, you’ll fill out information about yourself, your dependents, and your income.

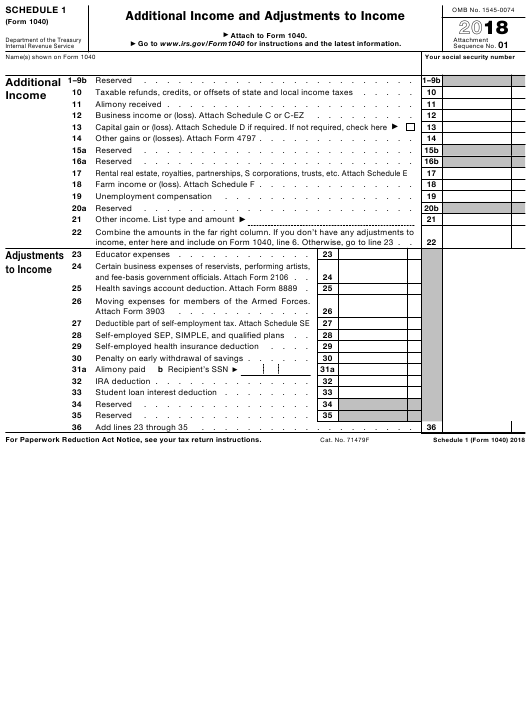

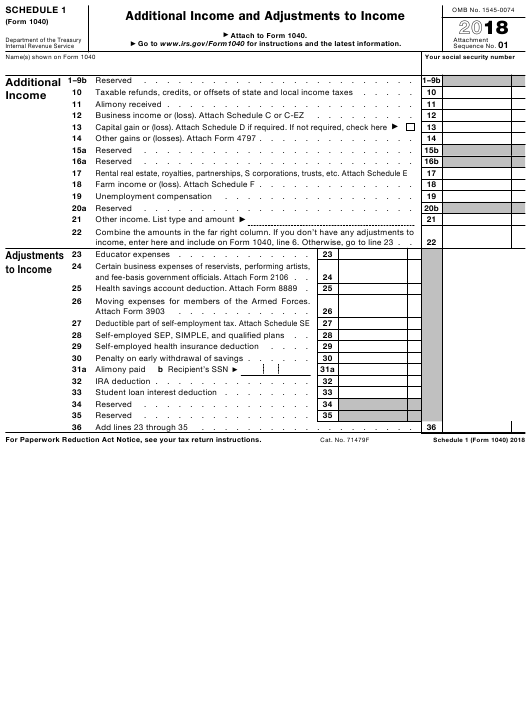

Schedule G is used to report income from the rental of personal property.Form 1040 is a lengthy document, consisting of nearly 100 lines that must be completed prior to submission. Schedule F is used to report a taxpayer's profit, loss, or deduction from a farming operation. Schedule E is used to report interest and dividend income. Schedule D is used to report capital gains and losses. Schedule C is used to report a taxpayer's profit, loss, or deduction from a business that is not incorporated.  Schedule B is used to report interest and dividend income. Schedule A is used to report a variety of deductions, including medical expenses, state, local, and foreign taxes, interest paid, charitable contributions, and miscellaneous expenses. A few of these publications are as follows: Form, along with Form 1040 TAX return forms, are the only ones that require the taxpayer to file Schedule The IRS has produced a few publications that provide additional inFormation about Form 1040. However, a taxpayer can get the detailed instructions and general rules for Form the IRS website. The attachments that can be filed along with Form 1040 pdf are as follows: The general instructions for file Form 1040 fillable are provided in this website. The second page of the Form is for filing one's income inFormation. The first page of the Form is for filing one's personal inFormation. It is a two-page Form consisting of three sections, with additional attachments. Form 1040 tax instructions is user-friendly.

Schedule B is used to report interest and dividend income. Schedule A is used to report a variety of deductions, including medical expenses, state, local, and foreign taxes, interest paid, charitable contributions, and miscellaneous expenses. A few of these publications are as follows: Form, along with Form 1040 TAX return forms, are the only ones that require the taxpayer to file Schedule The IRS has produced a few publications that provide additional inFormation about Form 1040. However, a taxpayer can get the detailed instructions and general rules for Form the IRS website. The attachments that can be filed along with Form 1040 pdf are as follows: The general instructions for file Form 1040 fillable are provided in this website. The second page of the Form is for filing one's income inFormation. The first page of the Form is for filing one's personal inFormation. It is a two-page Form consisting of three sections, with additional attachments. Form 1040 tax instructions is user-friendly.

0 kommentar(er)

0 kommentar(er)